Beckman Coulter将收购西门子临床微生物诊断业务

- 互联网2014年7月18日 8:58 点击:5553

![]()

2014年7月16日,贝克曼库尔特发布声明说已经同意收购西门子医疗诊断的临床微生物学业务,交易价格未透露。

西门子临床微生物学业务专门从事微生物鉴定和药敏试验(ID/AST),其业务运作基础是全球已经安装的超过6000台仪器,该业务是西门子诊断部门的一部分,去年完成了53.32亿美元(€39.42亿)的收入。

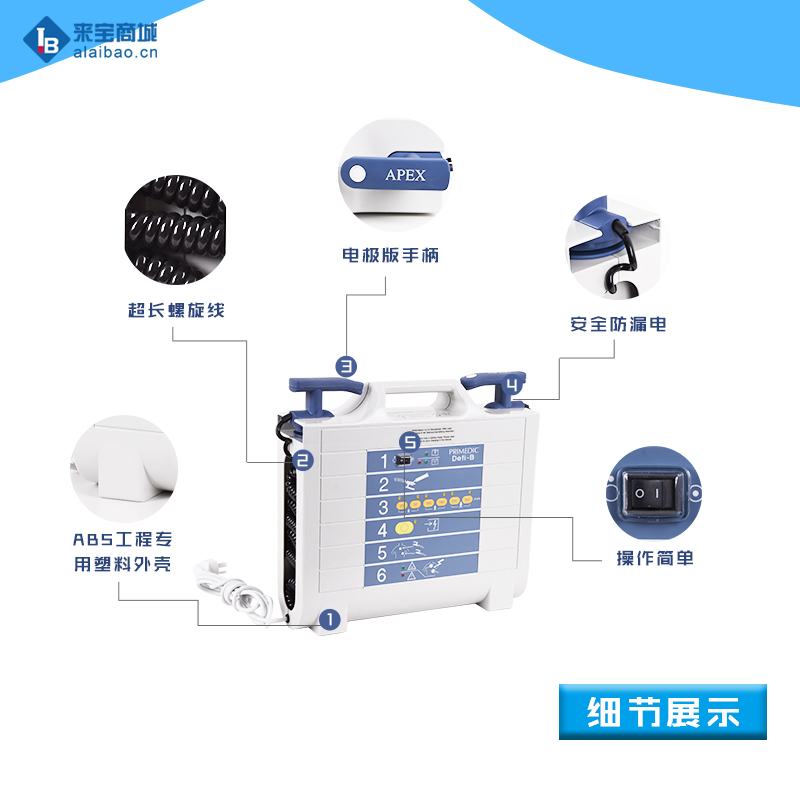

西门子微生物产品线包括MicroScan仪器、MicroScan板/消耗品,以及数据管理解决方案。MicroScan旨在提供高精度和优越的新兴耐药性检测。

“临床微生物学业务将是一个很好的补充,未来贝克曼库尔特的诊断业务将拥有更强大的声誉和市场地位,”贝克曼库尔特诊断业务董事长Arnd Kaldowski在一份声明中说。“在我们现有的产品和服务中增加ID/AST为我们创造了一个机会,让我们为实验室客户提供更多的产品和服务,以及改善对病人的护理。”

Kaldowski补充说,此次收购将扩大贝克曼库尔特提供差异化产品组合的能力,提升客户的临床功能,保持公司的持续增长。

西门子与贝克曼库尔特的这一交易预计在2015年第一季度完成。

Beckman To Buy Siemens Healthcare Diagnostics' Clinical Microbiology Business

Beckman Coulter said today it agreed to acquire the clinical microbiology business of Siemens Healthcare Diagnostics for an undisclosed price.

Siemens’ clinical microbiology business specializes in microbial identification and antibiotic sensitivity testing (ID/AST). The business operates with an installed base of over 6,000 instruments globally, and is part of Siemens’ diagnostics division, which finished last year with $5.332 billion (€3.942 billion) in revenue.

Today’s announcement by Beckman Coulter—an indirect, wholly owned subsidiary of Danaher—ends months of speculation over the future of Siemens’ clinical microbiology business. In March, BioMerieux CEO Jean-Luc Belingard told Reuters his company would look at acquiring the business from Siemens, which the wire service said had been offering through bankers “around $500 million” for its clinical microbiology operations, citing unnamed sources.

Siemens’ microbiology product line includes the MicroScan® Instruments and MicroScan panels/consumables, along with data management solutions. The MicroScan systems are designed to deliver high accuracy and superior detection of emerging resistance.

“The clinical microbiology business will be an excellent complement to Beckman Coulter's Diagnostics business with a strong reputation and market position,” Beckman Coulter Diagnostics President Arnd Kaldowski said in a statement. “Adding its ID/AST solutions to our existing products and services will create an opportunity to enhance our offerings to laboratory customers and improve patient care.”

Kaldowski added that the acquisition will expand Beckman Coulter’s product portfolio with differentiated analytical systems that elevate the company’s clinical capabilities for customers, while driving continued growth.

Siemens’ deal with Beckman Coulter is expected to close in the first quarter of 2015, subject to regulatory approvals and other customary closing conditions.

Earlier this month, Bloomberg reported that Siemens was looking to refocus on its energy and industrial businesses, citing unnamed sources as saying the German conglomerate was also looking to sell off its hospital database and IT business.

Adding credence to that talk was Siemens restructuring its operations in May, in part by giving greater operational independence to its healthcare businesses. CEO Joe Kaeser at the time insisted that the action was not intended to signal a sell-off but to increase their ability to address a changing market.

However, Morningstar analyst Debbie Wang speculated to the Boston Business Journal that Siemens may still wish to grow in diagnostics, saying the company was one of two most likely suitors for Alere. The comment followed a shakeup of Alere’s management that led an outspoken shareholder to say publicly that the point-of-care diagnostics developer had received unsolicited offers from potential strategic acquirers in the past year.

联系邮箱:kefu@labbase.net

版权与免责声明

- 凡本网注明“来源:来宝网”的所有作品,版权均属于来宝网,转载请必须注明来宝网, //www.next-search.com,违反者本网将追究相关法律责任。

- 本网转载并注明自其它来源的作品,目的在于传递更多信息,并不代表本网赞同其观点或证实其内容的真实性,不承担此类作品侵权行为的直接责任及连带责任。其他媒体、网站或个人从本网转载时,必须保留本网注明的作品来源,并自负版权等法律责任。

- 如涉及作品内容、版权等问题,请在作品发表之日起一周内与本网联系,否则视为放弃相关权利。