Bio-Techne 3亿美元收购ProteinSimple

- 互联网2014年6月19日 15:54 点击:3045

2014年6月17日,Bio-Techne宣布以3亿美元现金收购蛋白分析技术公司ProteinSimple,预计交易将于2014年7月31日完成。

ProteinSimple总部位于美国加州硅谷,2011年7月从Cell Biosciences改名为ProteinSimple,主要研发和制造用于蛋白研究的仪器和耗材。

目前,ProteinSimple在全球有员工200余人,在加拿大设有生产制造基地,在日本和中国设有销售办事处。根据其网站介绍,目前ProteinSimple在全球已经安装了14000多台蛋白分析系统。截至2014年5月31日的前12月,ProteinSimple收入5710万美元。

Bio-Techne Agrees to Buy ProteinSimple for $300M

Bio-Techne today announced a deal to buy protein analysis technology firm ProteinSimple for $300 million in cash.

The deal, which is anticipated to close on or around July 31, will be funded by Bio-Techne through cash on hand and a new revolving line of credit facility that Bio-Techne expects to obtain before the closing of the acquisition.

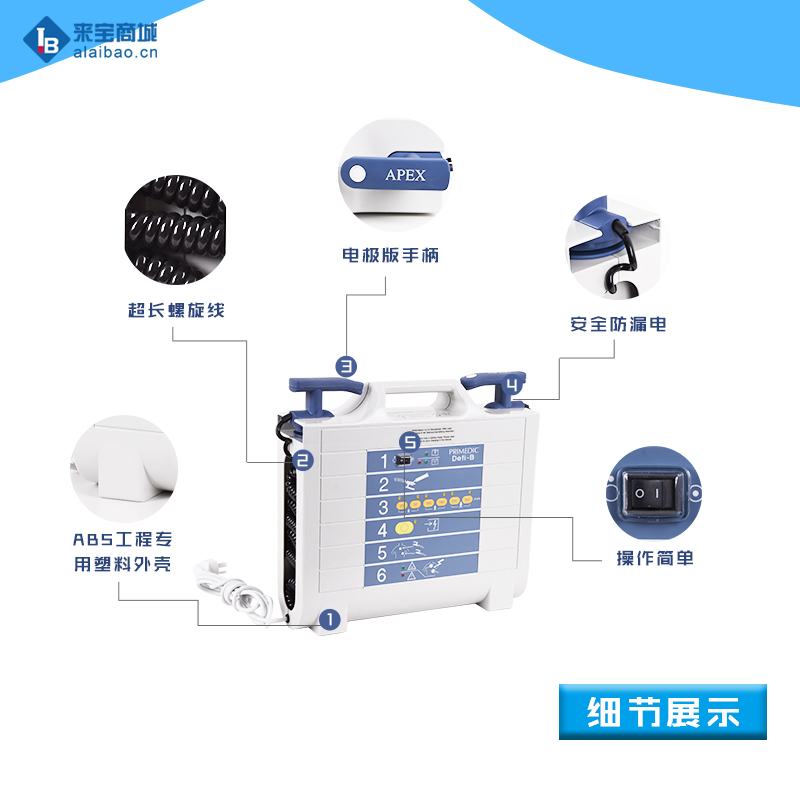

Based in Santa Clara, Calif., ProteinSimple, which changed its name from Cell Biosciences in July 2011, develops instruments and consumables for protein research. Its core product line is the Simple Western portfolio of systems and assays, including the Wes, which can deliver 25 Western blot results in less than three hours, Bio-Techne said.

According to ProteinSimple's website, it has installed more than 14,000 total systems globally.

For the 12 months ended May 31, ProteinSimple's revenues grew 30 percent year over year to $57.1 million. In early May, the company filed with the US Securities and Exchange Commission for a proposed initial public offering to raise as much as $86.3 million.

It has more than 200 employees with manufacturing operations in Canada and sales offices in Japan and China. Its customers include pharmaceutical and biotechnology companies, and, Bio-Techne said, the introduction of the Wes platform is anticipated to drive platform adoption in the academic research space.

Bio-Techne, based in Minneapolis, develops and manufactures purified proteins, such as cytokines and growth factors, antibodies, immunoassays, and biologically active small molecule compounds sold to biomedical researchers and clinical research labs. Bio-Techne CEO Charles Kummeth said in a statement that ProteinSimple's products fit naturally with his firm's offerings, and noted that Bio-Techne sells antibody reagents that are validated by Western blots, tying in with the needs of ProteinSimple's customers.

"This business adds significant benefits by expanding our sales force and signals our desire to participate as an innovative force in the laboratory instruments space to better leverage our consumables business of high quality reagents," Kummeth said.

ProteinSimple will operate as a division of Bio-Techne and will be headed by the firm's current CEO Tim Harkness. ProteinSimple's leadership team will remain in place after the closing of the acquisition, Bio-Techne said.

Leerink analyst Dan Leonard today called the deal "very attractive" to Bio-Techne and noted ProteinSimple's revenue growth rate, which he said was up 27 percent year over year in 2013. "We think it reasonable to assume ProteinSimple retains a [greater than 20 percent] revenue growth rate for the foreseeable future, driven off the back of its recent new product launch, Wes," he said in a research note.

He added that he expects the deal to be modestly dilutive to Bio-Techne in 2015 and accretive in 2016.

Amanda Murphy of William Blair also was positive on the deal and reiterated an Outperform rating on Bio-Techne. "We view ProteinSimple as a good deal that fits in line with [Kummeth's] strategy to expand more into instrumentation while leveraging [Bio-Techne's] proprietary content to drive more of a razor/razorblade model," she said in a research note.

联系邮箱:kefu@labbase.net

版权与免责声明

- 凡本网注明“来源:来宝网”的所有作品,版权均属于来宝网,转载请必须注明来宝网, //www.next-search.com,违反者本网将追究相关法律责任。

- 本网转载并注明自其它来源的作品,目的在于传递更多信息,并不代表本网赞同其观点或证实其内容的真实性,不承担此类作品侵权行为的直接责任及连带责任。其他媒体、网站或个人从本网转载时,必须保留本网注明的作品来源,并自负版权等法律责任。

- 如涉及作品内容、版权等问题,请在作品发表之日起一周内与本网联系,否则视为放弃相关权利。