Omnicell以2.75亿美元收购了医疗机器人公司Aesynt

- 互联网2015年11月26日 15:25 点击:2457

2015年10月29日,药品和耗材信息自动化管理解决方案供应商Omnicell以2.75亿美元收购了医疗机器人公司Aesynt。两家公司合并后,其产品包括药房机器人、自动静脉注射系统和物流管理软件。

Aesynt首席执行官Kraig McEwen站在Robot-Rx内

Aesynt和Omnicell表示,他们的自动化系统可以帮助降低医疗成本,提高病人的安全性。Aesynt销售的其他产品还有ROBOT-Rx和PROmanager-Rx配药机器人,Medcarousel和PACMED库存管理系统和MedShelf-Rx软件。

在KLAS的医疗保健供应商年度评选中,PROmanager-Rx被评为最佳中央药房机器人。它通过条形码管理库存、配药和预包装药丸库存。

Aesynt是成立于1990年的自动化医疗公司,1996年被McKesson以6500万美元收购。

2013年,Francisco Partners又以5200万美元从McKesson收购了McKesson自动化,并随后将其改名为Aesynt。

Aesynt首席执行官Kraig McEwen表示,“Francisco Partners提供了宝贵的战略支持、资金和资源,让我们能按战略执行实现新的增长。Omnicell和Aesynt通过创新和自动化履行经济实惠、安全的药物配送的承诺。今天,医疗机构拥抱Aesynt强大的医药管理工具,它将完善Omnicell的产品组合和国际业务。”

Omnicell增长有方

Omnicell创立于1992年,跟Aesynt一起给全球4000多急救机构提供支持,它拥有2200多名员工,年营收达6.5亿美元。Omnicell未说明Aesynt公司匹兹堡地区的员工将受到怎样的影响。

Omnicell首席执行官Randall Lipps表示,“通过在配药系统、中央药房机器人、IV机器人和分析系统增加不同的能力,此项收购表明我们继续为客户的医疗机构和病人提供领先的药房自动化解决方案。”

由于其OmniRx自动配药系统、WorkflowRx药品库存管理传送带和麻醉工作站,Omnicell被KLAS评为2015年最佳药房自动化设备供应商。

今年初,Omnicell收购了另外两家药房自动化供应商,德国的Mach4 Pharma Systems和英国的Avantec Healthcare。Omnicell表示,其目标是通过从医院和急诊后期护理到长期护理的整个连续护理过程,介入医药和供应管理。

Omnicell表示,Aesynt的收购还在等待监管部门的审批,但它会帮助其产品线的多样化和市场推广。为了此次收购,Omnicell从富国银行借贷了2.173亿美元,它计划在12月1日在纽约召开的第27届年度Piper Jaffray保健研讨会上进行讨论。

Omnicell, Inc. to Acquire Aesynt for $275 Million

October 29, 2015

Mountain View, Calif.

- Offers healthcare providers unparalleled flexibility and scalability in medication management systems

- Supports commitment to patient safety, efficiency & provider growth with leading central pharmacy and IV compounding automation solutions

- Immediately accretive to non-GAAP EPS

Omnicell, Inc., (NASDAQ:OMCL), a leading provider of medication and supply management solutions to healthcare systems, today announced it has entered into a definitive agreement to acquire Aesynt Incorporated. The acquisition would create the broadest product portfolio in the industry with significant offerings in automated dispensing systems, central pharmacy robotics, IV robotics and enterprise analytics. The combined company would support approximately 4,000 acute care facilities worldwide, have annual revenues of over $650 million and have approximately 2,200 employees.

“As hospitals search for ways to provide the best patient care and also the most efficient care, customers are looking for solutions that can be scaled and customized to fit the unique needs of their health system,” said Randall Lipps, Chairman, President and CEO, Omnicell. “By adding distinct capacities in dispensing systems, central pharmacy robotics, IV robotics and analytics, this acquisition demonstrates our continued commitment to offer our customers leading pharmacy automation solutions tailored to the specific needs of their facilities and patients. We also expect that as a combined entity we can accelerate innovation in the marketplace by leveraging the combined strengths of the Aesynt and Omnicell teams. Choice, innovation and value make this a great acquisition for Omnicell and our customers.”

Aesynt, based in Cranberry Township, Pa., is a leader in enterprise medication management. Specific solutions include:

IV Solutions: Full suite of automated and semi-automated solutions for the IV room including hazardous and non-hazardous solutions with IV workflow, compounding software and IV preparation analytics.

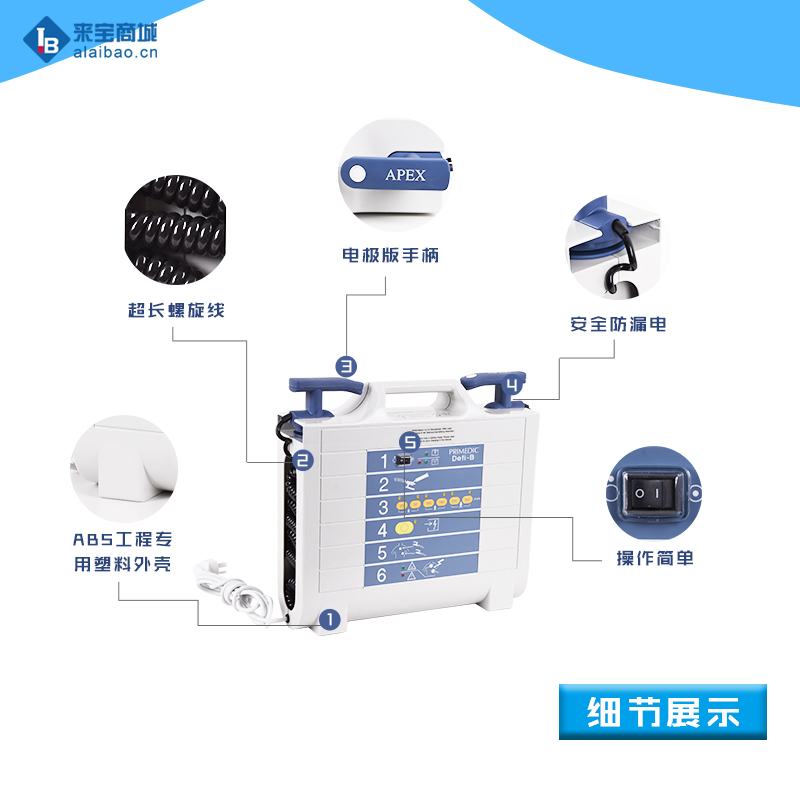

Central Pharmacy Solutions: Leading solutions including unit dose medication dispensing robots, vertical storage and dispensing of medications, open shelf inventory tracking and unit dose repackaging products and services.

Point of Care Solutions: Medication storage and dispensing cabinets for nursing units and operating rooms and narcotic medication storage and dispensing.

Enterprise Software: Dynamic, enterprise-wide medication logistics management software, automated procurement and order management, and reporting and analytics for inventory management and medication utilization.

“Omnicell and Aesynt share a passion for and commitment to affordable, safe medication delivery through innovation and automation,” said Kraig McEwen, Aesynt CEO. “Today, healthcare organizations embrace Aesynt’s robust medication management tools, which complement Omnicell’s product portfolio and international footprint. We are delighted to work with the Omnicell team. Our common goal to improve healthcare for everyone will now be realized.”

For more information please click here

Transaction Highlights

The contemplated total aggregate consideration is $275 million, in cash, plus cash on hand at signing minus indebtedness at signing, or approximately $217.3 million, subject to certain adjustments at closing as provided for in the securities purchase agreement. The completion of the transaction is subject to Hart-Scott-Rodino review and the satisfaction of other customary closing conditions, and is expected to close in 2016. Aesynt recorded approximately $182 million of revenue and approximately $20 million of adjusted EBITDA (unaudited) in the last twelve months ended June 30, 2015.

To finance the transaction, Omnicell will use cash available on its balance sheet and proceeds from $300 million in senior secured credit facilities. Omnicell and Wells Fargo Securities, LLC and Wells Fargo Bank, N.A. have executed a committed financing letter for the new senior secured credit facilities Omnicell intends to enter into at the time of closing the transaction. Assuming the transaction closes in 2016, it is expected to be immediately accretive to non-GAAP earnings per share.

Omnicell’s financial advisor in this transaction was Greenhill & Co., LLC and Sidley Austin LLP, Cooley LLP and Jones Day served as legal counsel.

Omnicell will discuss the transaction in more detail during the Omnicell Third Quarter 2015 earnings results conference call today. A live webcast and the accompanying presentation relating to the transaction will be available in the “Investor Relations” section of Omnicell’s website at www.Omnicell.com.

Conference call date: Oct. 29, 2015

Time: 2:30 p.m. Pacific (5:30 p.m. Eastern)

Dial in number: 1-800-696-5518 within the U.S. or 1-706-758-4883 for all other locations

Conference ID: 66699013

Internet users can access the conference call at: http://ir.omnicell.com/events.cfm.

A replay of the call will be available today at approximately 5:30 p.m. PT and will be available until 11:59 p.m. PT on November 12, 2015. The replay access numbers are 1-855-859-2056 within the U.S. and 1-404-537-3406 for all other locations, Conference ID # is 66699013.

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements relating to the anticipated acquisition of Aesynt and the timing and benefits thereof, the expected combined operations of Omnicell and Aesynt and Omnicell’s financing plans for the Aesynt acquisition. As such, they are subject to the occurrence of many events outside Omnicell's control and are subject to various risk factors that could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Risks include, without limitation, risks related to Omnicell’s ability to complete the acquisition on the proposed terms and schedule (including risks relating to regulatory approvals for the transaction); whether Omnicell or Aesynt will be able to satisfy their respective closing conditions related to the acquisition; whether Omnicell will obtain financing for the transaction on the expected timeline and terms; risks associated with business combination transactions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the acquisition will not occur; risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed acquisition; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; and the possibility that if the combined company does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Omnicell’s shares could decline. Other risks that contribute to the uncertain nature of the forward-looking statements include our ability to take advantage of the growth opportunities in medication management across the spectrum of healthcare settings from long term care to home care, unfavorable general economic and market conditions, risks to growth and acceptance of our products and services, including competitive conversions, and to growth of the clinical automation and workflow automation market generally, the potential of increasing competition, potential regulatory changes, the ability of the company to improve sales productivity to grow product bookings, to develop new products and to acquire and successfully integrate companies. These and other risks and uncertainties are described more fully in Omnicell's most recent filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements contained in this press release speak only as of the date on which they were made. Omnicell undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

About Aesynt

Aesynt combines years of healthcare expertise with a comprehensive portfolio of pharmacy automation and information management tools. Aesynt partners with healthcare organizations to fully optimize all medication forms enterprise-wide, driving dramatic cost reductions and improved patient safety. With leading solutions for sterile compounding, enterprise-wide inventory management, and medication dispensing, Aesynt is committed to developing innovative solutions to solve the most pressing challenges for our global healthcare partners. For more information, visit www.aesynt.com or follow Aesynt on Twitteror LinkedIn.

About Omnicell

Since 1992, Omnicell (NASDAQ: OMCL) has been creating new efficiencies to improve patient care, anywhere it is delivered. Omnicell is a leading supplier of comprehensive automation and business analytics software for patient-centric medication and supply management across the entire health care continuum—from the acute care hospital setting to post-acute skilled nursing and long-term care facilities to the home.

More than 3,000 customers worldwide have utilized Omnicell Automation and Analytics solutions to increase operational efficiency, reduce errors, deliver actionable intelligence and improve patient safety. Omnicell Medication Adherence solutions, including its MTS Medication Technologies brand, provide innovative medication adherence packaging solutions to help reduce costly hospital readmissions. In addition, these solutions enable approximately 7,000 institutional and retail pharmacies worldwide to maintain high accuracy and quality standards in medication dispensing and administration while optimizing productivity and controlling costs.

联系邮箱:kefu@labbase.net

版权与免责声明

- 凡本网注明“来源:来宝网”的所有作品,版权均属于来宝网,转载请必须注明来宝网, //www.next-search.com,违反者本网将追究相关法律责任。

- 本网转载并注明自其它来源的作品,目的在于传递更多信息,并不代表本网赞同其观点或证实其内容的真实性,不承担此类作品侵权行为的直接责任及连带责任。其他媒体、网站或个人从本网转载时,必须保留本网注明的作品来源,并自负版权等法律责任。

- 如涉及作品内容、版权等问题,请在作品发表之日起一周内与本网联系,否则视为放弃相关权利。