丹纳赫集团(Danaher)将68亿美元收购贝克曼库尔特

- Danaher2011年2月9日 9:05 点击:5008

北京时间2月7日晚间消息,美国专业仪器、工业技术以及工具和部件制造商丹纳赫集团(Danaher Corp)(DHR)周一宣布,该集团已经同意以68亿美元的价格收购实验室设备生产商贝克曼库尔特有限公司(Beckman Coulter, Inc)(BEC),旨在增强该集团的诊断产品部门。

丹纳赫集团今天发表声明称,该公司将在7天内开始对贝克曼库尔特的所有在外流通股份发起每股83.50美元的收购要约。丹纳赫集团表示,这一收购价较贝克曼库尔特去年12月9日的收盘价高出45%左右。在去年12月10日,市场开始猜测贝克曼库尔特将对外出售。

据彭博社编纂的数据显示,这项交易的总价值相当于贝克曼库尔特EBITDA(即未计利息、税项、折旧及摊销前的利润)的7.1倍;与此相比,此前10多桩并购交易的同一倍数为26倍。

丹纳赫集团首席执行官劳伦斯-卡尔普(Lawrence Culp)曾在去年12月份表示,该集团将在未来4到6个季度中进行总额大约为40亿美元的并购交易。今年截至目前为止,丹纳赫集团仅宣布了一项收购交易,内容是以大约4.7亿美元的价格收购比利时软件制造商艾司科(EskoArtwork)。

去年12月份曾有熟知内情的消息人士透露,贝克曼库尔特一直都在寻求对外出售。在此以前,曾有几家资产收购公司接洽贝克曼库尔特,有意将这家公司变为私人控股公司。

贝克曼库尔特总部位于加利福尼亚州的布雷亚(Brea),是目前世界实验医学领域中仪器设备、试剂、应用软件开发和制造最强的厂商之一。丹纳赫集团称,该集团将把贝克曼库尔特整合到自身旗下的生命科学部门,该部门主要负责生产诊断设备。在2010年中,丹纳赫集团生命科学部门的营收为23亿美元,在该集团总营收中所占比例大约为17%。

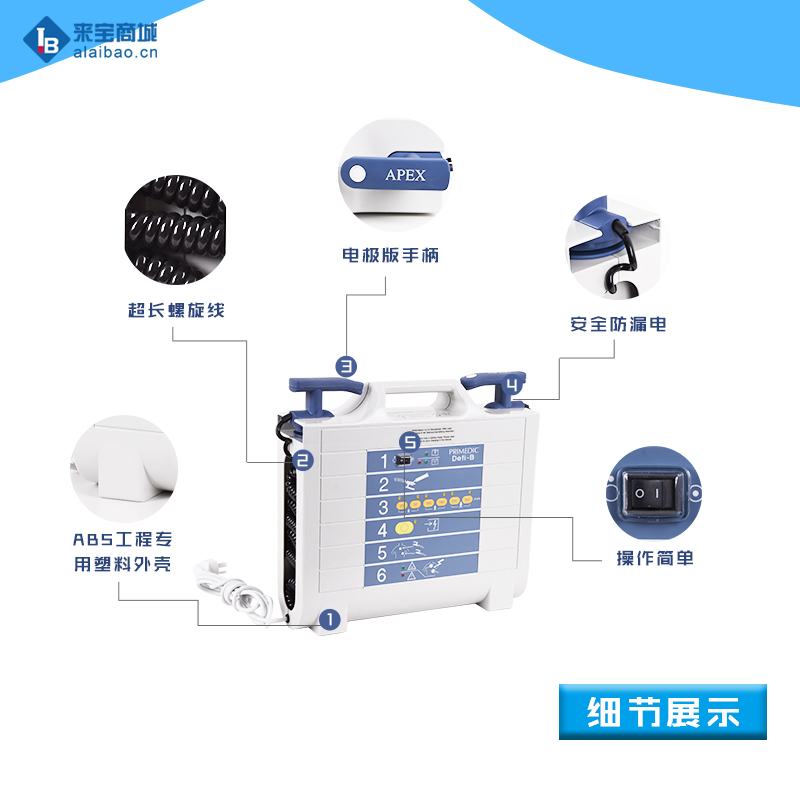

贝克曼库尔特的产品被用于诊断疾病和新药开发,包括离心机、血液分析仪和细胞分选仪等。截至2009年底为止,贝克曼库尔特的员工总数大约为1.18万人,销售额为32.6亿美元左右。

在纽约证券交易所(NYSE)今天的盘前交易中,截至美国东部时间8:18(北京时间9:18)为止,贝克曼库尔特的股价上涨7.40美元,至82.57美元,涨幅为9.8%;丹纳赫集团股价上涨1.31美元,至49.29美元,涨幅为2.7%。

Danaher to Acquire Beckman Coulter, Inc. for $83.50 per share or $6.8 Billion

Washington, D.C., February 7, 2011 – Danaher Corporation (NYSE:DHR) announced today that it has entered into a definitive merger agreement with Beckman Coulter, Inc. (NYSE: BEC) pursuant to which Danaher will acquire Beckman Coulter by making a cash tender offer to acquire all of the outstanding shares of common stock of Beckman Coulter at a purchase price of $83.50 per share, for a total enterprise value of approximately $6.8 billion, including debt assumed and net of cash acquired.

The Beckman Coulter Board of Directors has unanimously recommended that Beckman Coulter shareholders accept and tender their shares into the offer, which represents a premium of approximately 45% to Beckman Coulter’s closing price on December 9, 2010, the date on which market speculation began regarding a potential sale of the Company. The offer is subject to customary conditions, including tender of a majority of the outstanding shares into the offer (on a fully diluted basis), applicable regulatory approvals and the absence of a material adverse change with respect to Beckman Coulter. The transaction is expected to be completed in the first half of 2011.

With annual revenues of approximately $3.7 billion, Beckman Coulter develops, manufactures and markets products that simplify, automate and innovate complex biomedical testing. Its diagnostic systems are found in hospitals and other clinical settings around the world and produce information used by physicians to diagnose disease, make treatment decisions and monitor patients. Scientists use its life science research instruments to study complex biological problems including causes of disease and potential new therapies or drugs.

Beckman Coulter would become part of Danaher’s Life Sciences & Diagnostics segment, joining Danaher’s Leica, AB Sciex, Radiometer and Molecular Devices businesses.

Danaher’s President and CEO, H. Lawrence Culp, Jr., said, “Beckman Coulter is an iconic company with a great brand, broad reach and technology leadership; well positioned in the markets it serves. Beckman provides an excellent complement to our existing Life Sciences & Diagnostics businesses. Being part of Danaher, Beckman associates will have the opportunity to leverage the power of the Danaher Business System, including the processes by which Danaher accelerates growth through new product innovation and driving sales, marketing and service, as well as its strength in continuously expanding margins.”

Danaher will host a conference call to discuss the transactions on February 7, 2011 at 8:30 AM ET. The U.S. dial-in number is 800-967-7134; the international dial-in number is 719-325-2490; with reference ID Code 3770892. A telephone replay will be available by dialing 888-203-1112 in the US; and 719-457-0820 internationally; with ID Code 3770892. The replay will be available through February 14, 2011. The conference call and replay will also be available via webcast in the Investor section of www.danaher.com.

About Danaher

Danaher is a diversified technology leader that designs, manufactures, and markets innovative products and services to professional, medical, industrial, and commercial customers. Our portfolio of premier brands is among the most highly recognized in each of the markets we serve. Driven by a foundation provided by the Danaher Business System, our 48,000 associates serve customers in more than 125 countries and generated $13.2 billion of revenue in 2010. For more information please visit our website: www.danaher.com.

Notice to Investors

This announcement is neither an offer to purchase nor a solicitation of an offer to sell securities. The tender offer for the outstanding shares of Beckman Coulter common stock described in this press release has not yet commenced. At the time the planned offer is commenced an indirect, wholly-owned subsidiary of Danaher will file a tender offer statement on Schedule TO with the Securities and Exchange Commission and Beckman Coulter will file a solicitation/recommendation statement on Schedule 14D-9 with respect to the planned offer. The tender offer statement (including an offer to purchase, a related letter of transmittal and other offer documents) and the solicitation/recommendation statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to Beckman Coulter security holders at no expense to them. In addition, all of those materials (and all other offer documents filed with the SEC) will be available at no charge on the SEC’s Web site: www.sec.gov.

Forward Looking Statements

Statements in this release that are not strictly historical, including statements regarding the proposed acquisition, the expected timetable for completing the transaction, future financial and operating results, benefits and synergies of the transaction, future opportunities for the combined businesses and any other statements regarding events or developments that we believe or anticipate will or may occur in the future, may be "forward-looking" statements within the meaning of the federal securities laws, and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements. These factors include risks and uncertainties related to, among other things: general economic conditions and conditions affecting the industries in which Danaher and Beckman Coulter operate; the uncertainty of regulatory approvals; the parties’ ability to satisfy the tender offer and merger agreement conditions and consummate the transaction; Danaher’s ability to successfully integrate Beckman Coulter’s operations and employees with Danaher’s existing business; the ability to realize anticipated growth, synergies and cost savings; and Beckman Coulter’s performance and maintenance of important business relationships. Additional information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available in Danaher’s SEC filings, including Danaher’s Annual Report on Form 10-K for the year ended December 31, 2009 and Quarterly Report on Form 10-Q for the quarterly period ended October 1, 2010 as well as Beckman Coulter’s SEC filings, including Beckman Coulter’s Annual Report on Form 10-K for the year ended December 31, 2009 and Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2010. These forward-looking statements speak only as of the date of this release and Danaher does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law.

Please contact:

Matt R. McGrew

Vice President, Investor Relations

Danaher Corporation

2099 Pennsylvania Avenue

Washington, D.C. 20006

Telephone: (202) 828-0850

Fax: (202) 828-0860

联系邮箱:kefu@labbase.net

版权与免责声明

- 凡本网注明“来源:来宝网”的所有作品,版权均属于来宝网,转载请必须注明来宝网, //www.next-search.com,违反者本网将追究相关法律责任。

- 本网转载并注明自其它来源的作品,目的在于传递更多信息,并不代表本网赞同其观点或证实其内容的真实性,不承担此类作品侵权行为的直接责任及连带责任。其他媒体、网站或个人从本网转载时,必须保留本网注明的作品来源,并自负版权等法律责任。

- 如涉及作品内容、版权等问题,请在作品发表之日起一周内与本网联系,否则视为放弃相关权利。